Capital for startups has become scarcer. If the rest of 2024 plays out in the same way as the first quarter, total investment volumes might be as low as £12.8bn for the UK’s private companies.

That’s a fall of 55% from the annual peak of £28.4bn in 2021. It’s hard to put a positive spin on those numbers when taken as a whole. But we need to remember that some very different companies and very different inventors sit under that headline figure.

If you’re in the right sector, prospects look considerably rosier.

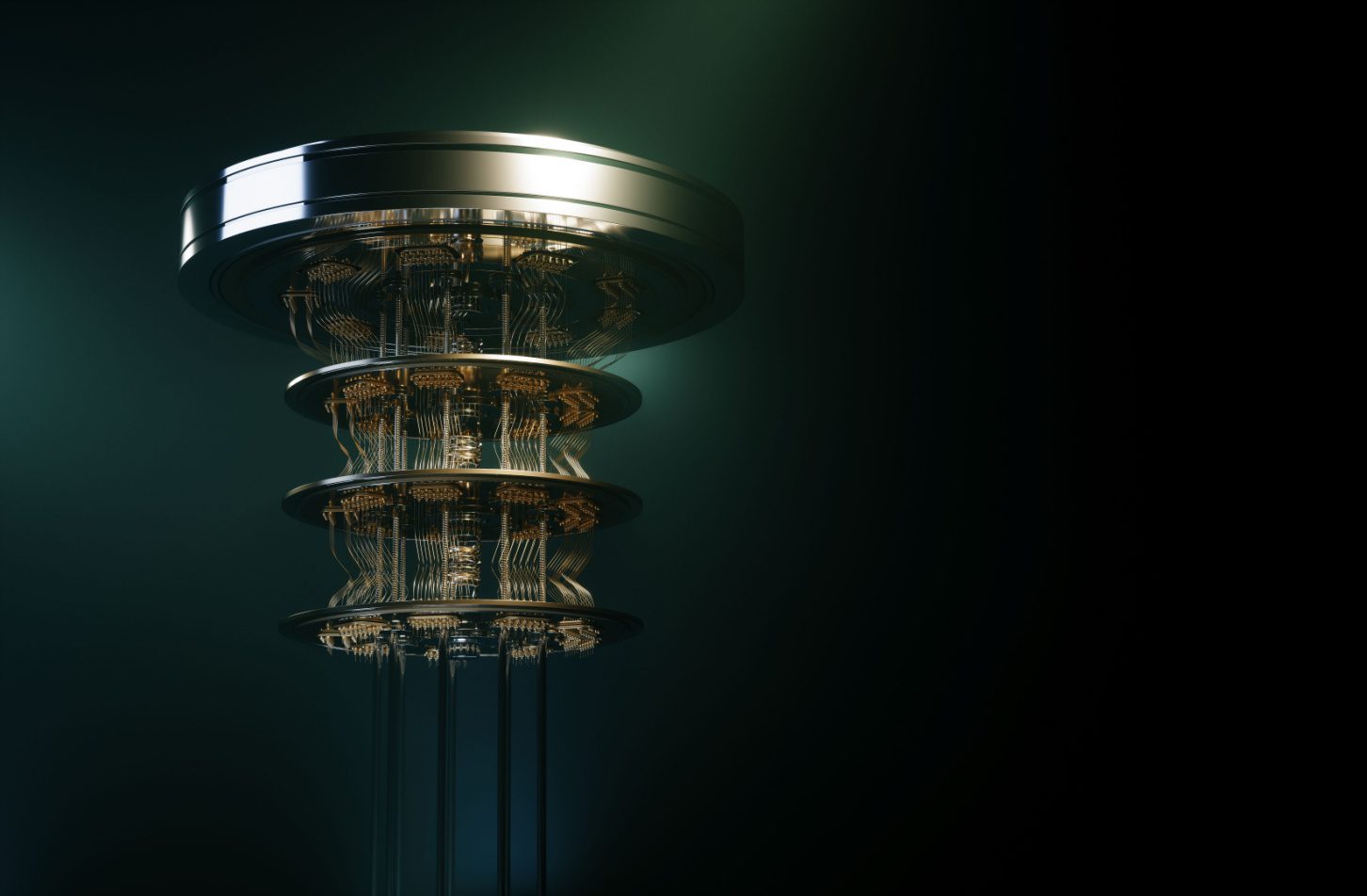

One of the more eye-catching trends from Beauhurst’s data is the increasing relevance of deep tech businesses to the UK’s startup economy. Deep tech has gone from representing 5% of investment in 2012 to 22% so far this year. That’s not to say the sector hasn’t seen its own downturn: investment is down from the 2021 high too, but the drop has been less severe – hence the growing share.

And that’s to say nothing of the investment and support these companies receive from the public sector. Last year deep tech companies received £530m from Innovate UK, up 33% from 2022.

What’s behind deep tech growth?

There are a couple of reasons for these increases. Universities have been increasing their spinout activity, which stimulates the demand for deep tech investment. On the supply side, while there are still definitely gaps in deep tech funding, there are new investors emerging to fund these companies – at least at the early stage.

These new investors, sometimes with a climate focus, have tapped a different pool of (often younger) limited partners (LPs) from those that back the typical / established software VCs. And some of those same LPs are also doing angel rounds.

But deep tech is perhaps the archetypal capital-intensive sector, so it’s a reasonable bet that some kind of funding gap will likely rear its head as an issue in the future. But for now, at least, investment activity looks robust. This might be because the capital requirements have changed in two significant ways.

The first applies to companies in all tech sectors: there are many more services and utilities that a startup or spinout can now access fractionally. Fractional CFOs, even CROs can be found easily; office space can be bought by the desk (if you buy it all); even web instances can be spun up or down as needed.

The second way they’ve changed is specific to deeptech: AI and ML are allowing companies to experiment outside of expensive lab space. An investor’s money goes further than it used to.

Investor appetite for deep tech companies is not equal, and some subsectors are garnering more interest than others. Precision agriculture, regenerative medicine, and quantum all saw the amount invested by private investors in 2023 more than double compared to the year before.

Henry Whorwood is the managing director of research & consultancy at Beauhurst.

The post Deep tech has dodged the worst of the funding downturn – here’s why appeared first on UKTN.