Fintech has returned to being the UK’s most-funded tech sector but the country is at risk of losing its crown, according to a handful of new policy recommendations from the likes of Monzo, Revolut and The Tony Blair Institute for Global Change.

Two major fintech policy reports have been published this week as data revealed the sector raised $1.4bn in the first quarter, more than any other in the UK.

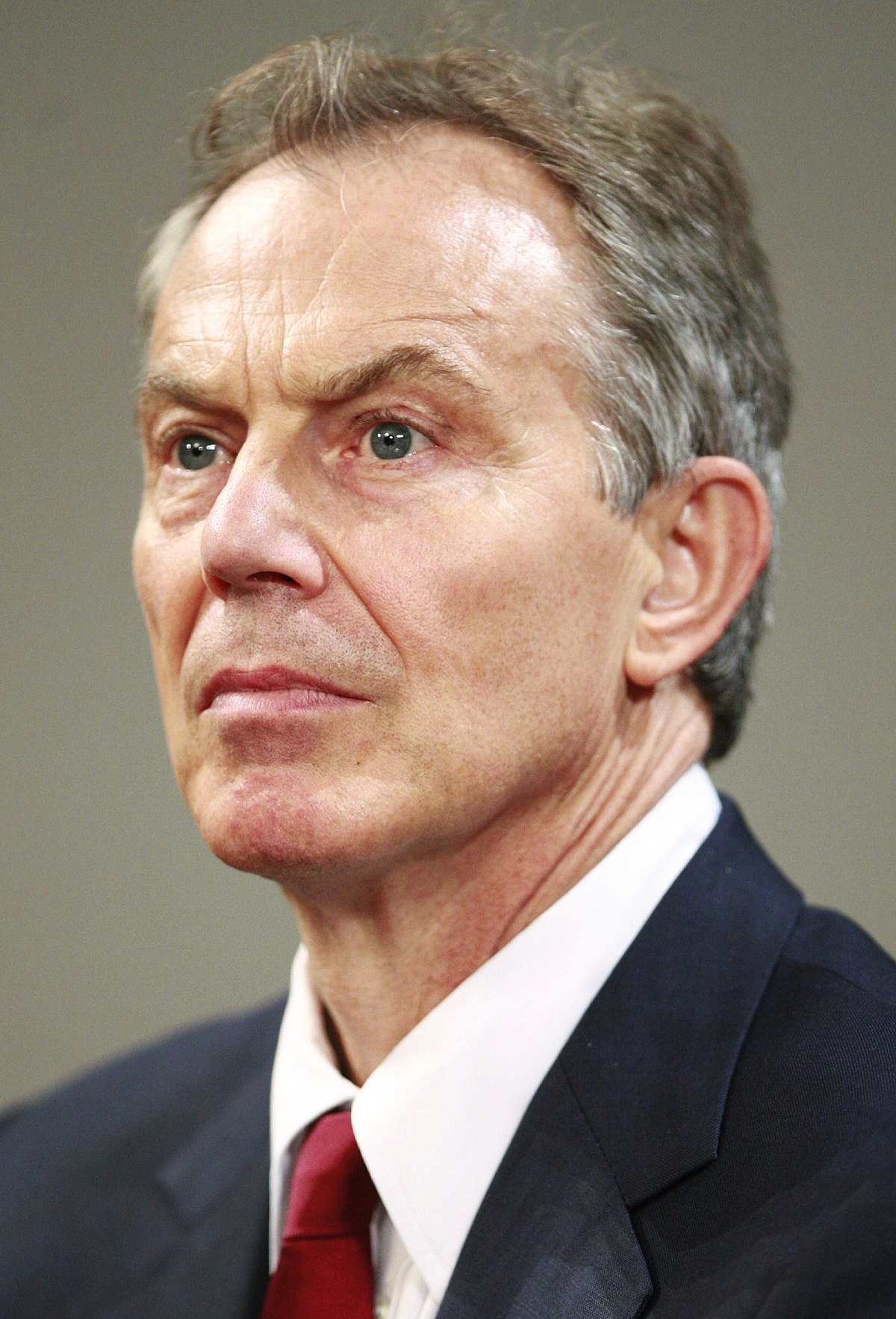

The Tony Blair Institute for Global Change, founded by the former prime minister, along with lobby group the Startup Coalition, jointly published the Progressive Vision for Fintech report on Wednesday.

The report, largely directed at a post-general election Labour government, calls for a review of how financial incentives, including R&D tax relief and Enterprise Investment Scheme (EIS) support, are delivered.

The report said HMRC has “significantly increased the time it takes for applications to be processed” and small businesses face uncertainty over what levels of support they qualify for.

The report recommended that eligibility for investment incentives be widened and the review process streamlined.

It also called for government support in boosting UK fintech’s international reach by including open banking rules in global trade agreements.

Other recommendations include the Treasury regularly producing documents parallel to the Financial Conduct Authority to ensure visibility in the overlap of policy and regulation, increasing the resources made available to regulators, and equipping financial regulators to oversee the implementation of AI in the sector.

The report also called for quicker movement on regulating buy now pay later, tackling authorised push payment fraud and a faster rollout of the mansion house reforms to bring pension cash into innovative businesses.

Earlier this week a separate report from the Unicorn Council for UK FinTech (UCFT) – a coalition of the largest UK fintechs including Monzo, Revolut, Zilch and ClearBank – similarly made calls to reform the government’s approach to fintech.

The council, like The Tony Blair Institute, called for expanded support of the EIS and R&D tax relief. However, it recommended explicit inclusion of fintech within the scope of R&D credits as it claimed the sector, while innovative, doesn’t qualify as often as it should.

Other recommendations for the council include scrapping stamp duty, greater tax relief for those selling business assets and the introduction of a VAT rebate scheme for early-stage fintechs.

“Our sole purpose with the UCFT is crafting the go-to policy playbook that outlines precisely what the government, regulators and the broader ecosystem need to address if our generation of fintech businesses are to continue thriving on a global stage,” said Philip Belamant, co-founder and CEO of Zilch.

The post From Tony Blair to Monzo, key players demand UK fintech reform appeared first on UKTN.