As many as 1.5m households are expected to face a mortgage payment hike this year as their fixed-rate deals come to an end

- ‘Sleepless nights’: UK homeowners fear impact of 2024 mortgage timebomb

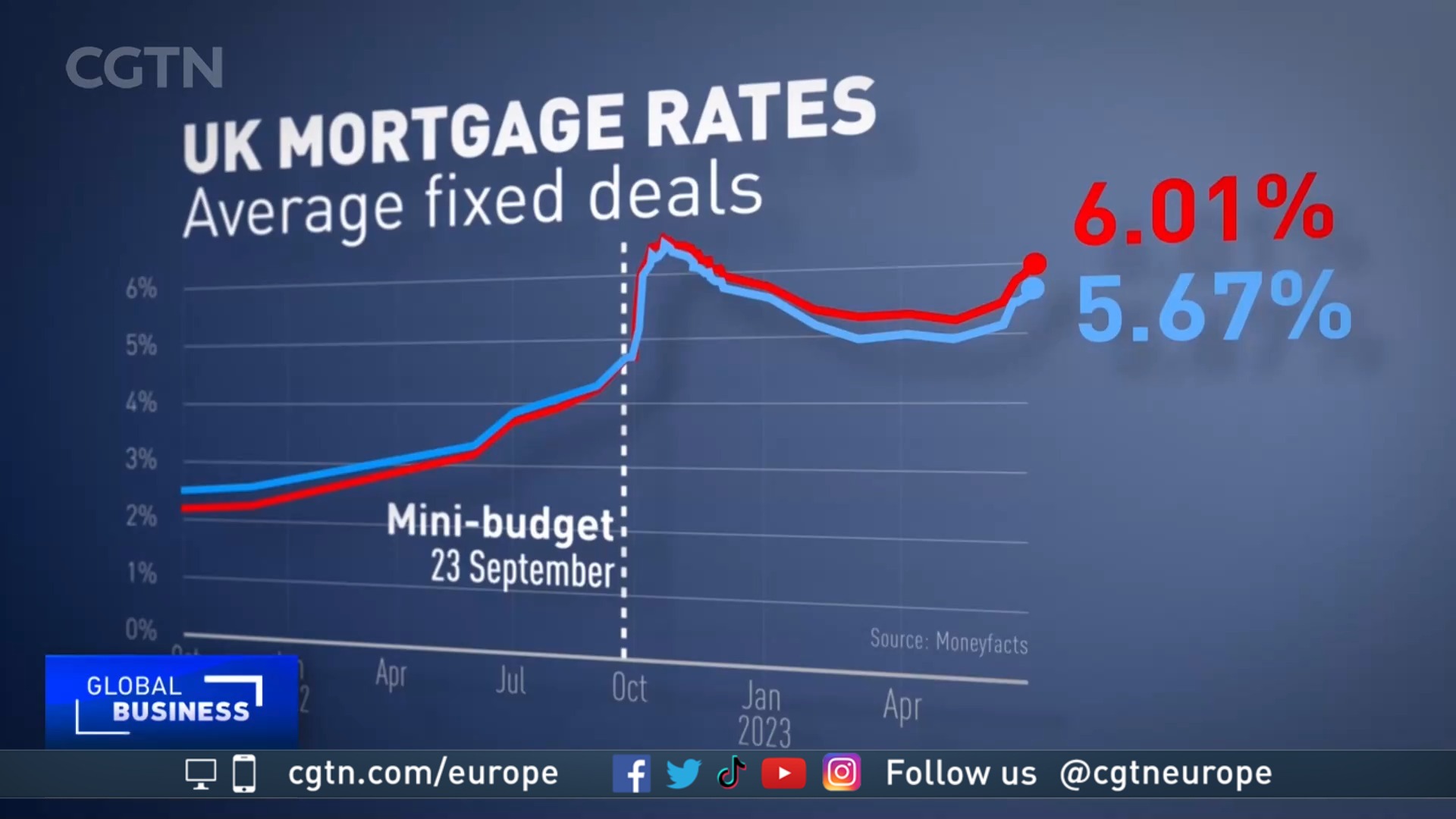

Homeowners are facing a £19bn surge in mortgage costs as millions more fixed-rate deals expire and borrowers are forced to renegotiate their home loans following the toughest round of interest rate increases in decades.

Despite an escalating price war between major lenders cutting the cost of remortgaging in recent days, economists at the US investment bank Goldman Sachs said many UK households would still face a dramatic leap in repayments compared to the deals they were leaving behind.

Continue reading…