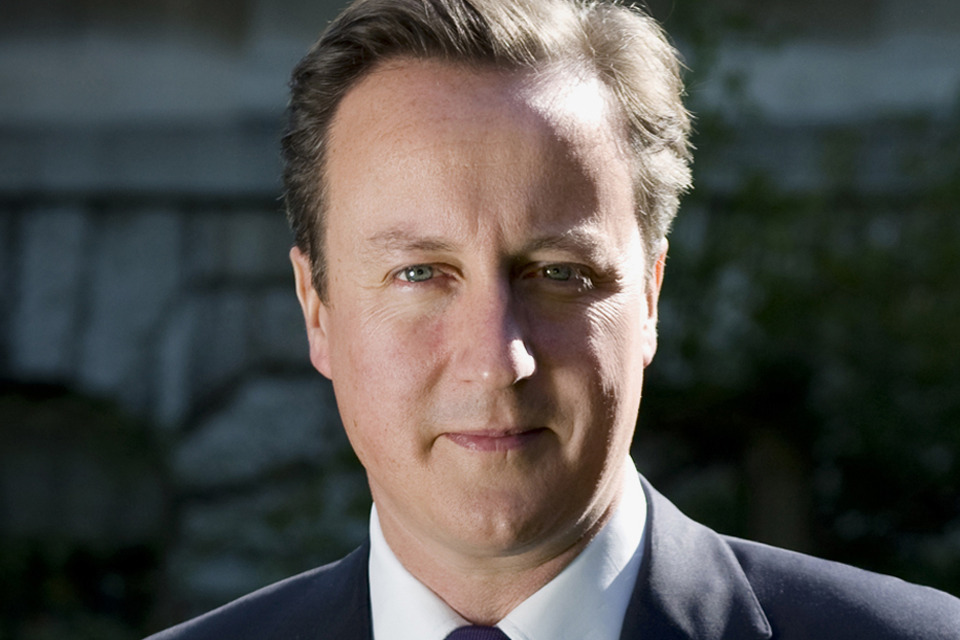

Former PM, who became a life peer last week, under scrutiny over use of financier’s aircraft and offshore trust

Tax officials are understood to be examining whether David Cameron failed to fully disclose taxable perks such as flights on private planes when he worked for the collapsed lender Greensill Capital, the Guardian can reveal.

In particular, officials are said to be looking at a number of flights that took off or landed near his house in Oxfordshire and also in Cornwall, where the foreign secretary has a holiday home. They are also examining an offshore trust that it is understood was created by Greensill to pay him extra benefits.

Continue reading…