Majority of MPC rate-setters back hike of 0.5 percentage points despite fears UK is entering a long recession

- Analysis: UK borrowers face a serious reality check

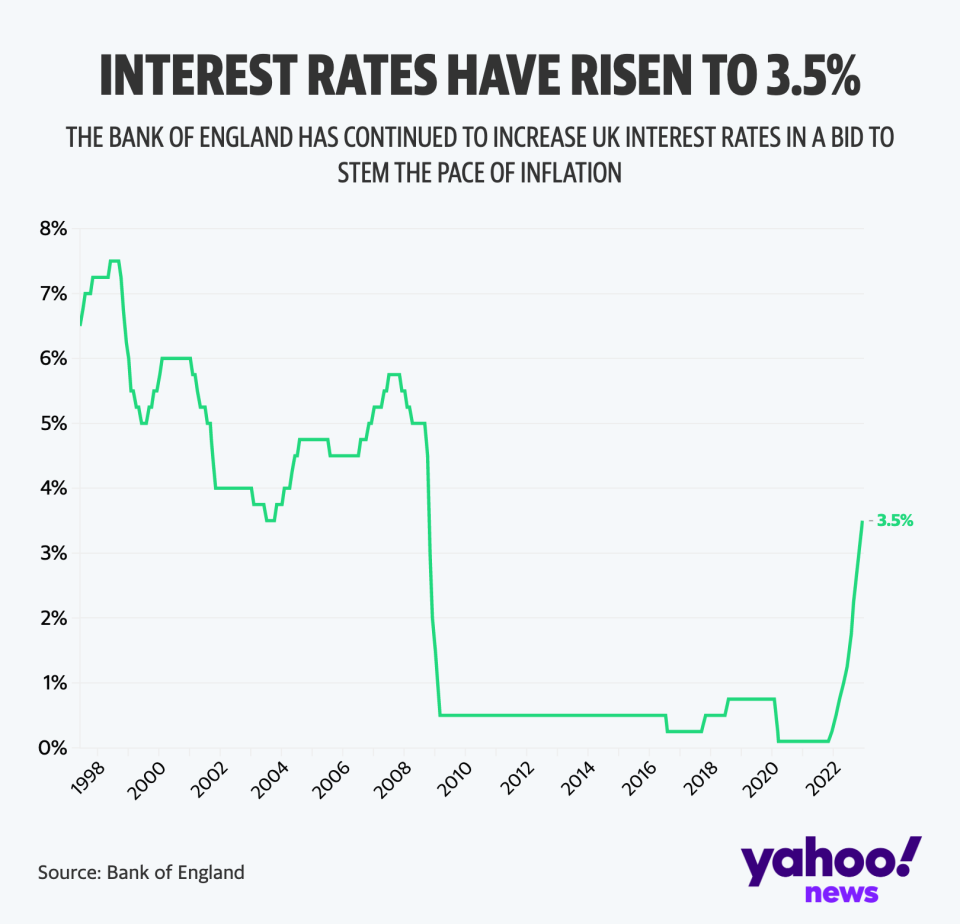

Mortgage payers are braced for higher borrowing costs, after the Bank of England pushed up its base rate by 0.5 percentage points to 3.5% despite saying inflation has peaked and Britain is about to enter “a prolonged recession”.

The Bank hiked interest rates on Thursday for the ninth time in a year, to the highest level in 14 years, but told borrowers to prepare for fresh increases in the new year.

Continue reading…