Paris-based core banking provider TagPay secured €25M (approx £22M) funding from Long Arc Capital to strengthen its sales, product, and technical teams and to fund growth.

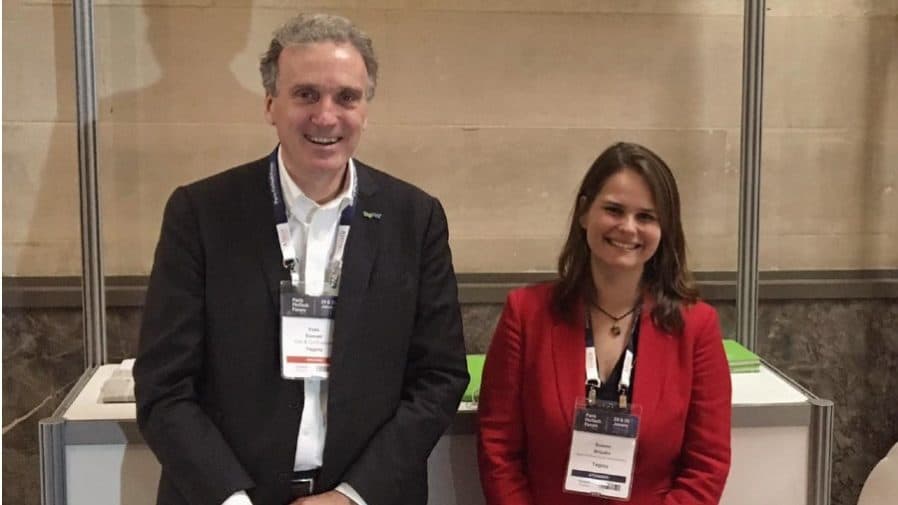

This funding gives New York-based private equity firm a majority stake in TagPay, which previously raised €7M (approx £6.3M). Founded by Yves Eonnet and Hervé Manceron in 2005, the French company offers a cost-efficient, next-gen core banking system to financial institutions.

Allows financial institutions to innovate and improve

TagPay’s solution transforms once costly and inefficient legacy systems into scalable, open-architecture platforms, that allow financial institutions to innovate and improve customer experience. Furthermore, new market entrants to focus on building their offerings and distributing their products.

With 20 financial institutions as clients and more than 7 million accounts, the company aims to support the digital transformation taking place in the financial sector.

Aims to double its customer base

By 2023, the French company aims to double its banking customer base while multiplying by 5 the number of end-customers provided with secured digital banking services. It’s worth mentioning that, the co-Founders Yves Eonnet (CEO) and Hervé Manceron (COO) will continue in their leadership roles with the company.

“The regulatory evolution, the new expectations of end customers and the disruption in financial services makes the modernization of core banking systems a necessity,” said Yves Eonnet, CEO of TagPay. “Today, thanks to its open and agile architecture system, TagPay is the premier solution to address these challenges. We are very happy to have the support of Long Arc Capital, whose financial and operational support will allow us to grow rapidly over the next 3 years.”

Vincent Fleury, Partner at Long Arc added, “As financial institutions begin to see the benefits of next-generation core banking systems, TagPay will demonstrate its full potential, offering a configurable and connectable banking environment that meets the highest security standards. We are delighted to support them in this new phase of growth.”

The post Paris-based core banking platform TagPay raises £22M to transform financial institutions appeared first on UKTN (UK Tech News).