The pandemic and subsequent lockdowns afforded most of us time to stop and ask ourselves what we really want from our careers. With restrictions (hopefully) a thing of the past, is now the time to shake things up and go in a different direction?

Has the business you set up run its course and is it time for something new? Alternatively, it could be time to take the reins yourself and adapt your business to take advantage of the many post-pandemic opportunities in the technology sector.

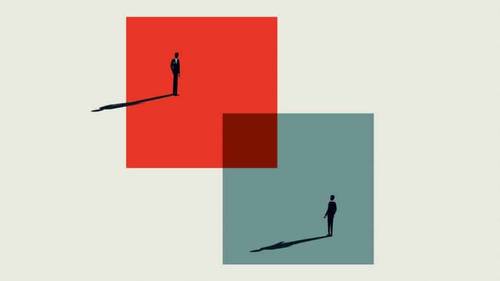

It might even be time to buy out your business partner.

This parting need not be acrimonious. In fact, most buyouts are mutually agreed and ultimately a win-win. The partner with the most passion for the business gets a controlling interest, while the other gets to cash in the fruits of their hard work over the years.

This article shares four key considerations if you’re weighing up whether to buy out your business partner.

Obtain a business valuation

You need to make sure that you get an accurate business valuation as a first step. This will ensure that you can set a fair price for your partnership buyout and that all parties are on the same page from the outset.

It will also help you see whether taking sole ownership of the company is a good long-term investment.

Employ an experienced professional to negotiate terms

Even with the most amicable of buyouts, having an independent solicitor to negotiate the terms of the buyout on your behalf is important. While you may not see the need, it is in everyone’s interest to keep proceedings as formal as possible. An experienced solicitor will have likely helped hundreds of people through the process successfully and they will make sure each party gets exactly what they agreed out of the arrangement.

There will be a lot of detail and technical considerations to iron out. For example, you will want to make sure the financial obligations of each party are clearly laid out and that all matters relating to liability are dealt with in the agreement. Moreover, other common issues with many buyouts (especially in the technology sector) are what to do with the network of business relationships you and your partner have built up over the years.

Another area of contention can be who owns the valuable intellectual property that’s integral to the business. You will also want to have any confidentiality requirements of both sides agreed upon in advance. Without your partner in the business, it’s plausible that some clients may no longer want to renew their contracts or initiate new projects.

Without the necessary intellectual property vested within the business, is the business really worth anything? The transition needs to be managed very carefully, so take the time to go over all the details during the negotiations; a good lawyer will help you through it.

Consider financing options

You may well have the finance to buy your partner out without needing any additional sources of funding. However, if this is not the case, you will need to work through your options and find the right financing strategy.

If your business has a history of being profitable, you may be able to secure a small business loan. Some lenders, however, tend to avoid providing loans for servicing buyouts, because the money will not actually be benefitting the business itself. That said, there are an increasing number of alternative lenders emerging who specialise in this kind of funding and with investment activity in the UK’s technology going from strength to strength, you can be confident of striking while the iron is hot and finding the right financing strategy for your buyout.

Outside of borrowing from third parties, your business partner may also be open to alternatives such as creating a long-term payment plan rather than buying them out in one go.

Make sure a buyout is the best choice

Last, but by no means least, it’s important to explore all options before committing to a buyout. Talk with your business partner about what your goals are and how you see the future of the business. There may be another way of allowing your partner to step away.

There are a number of other ways you could go about reducing the involvement and influence of your business partner without having to buy them out.

Indeed if your business valuation comes back lower than you had hoped it might be best to dissolve the business, split the assets and go your separate ways.

Hector Freyne is a solicitor in the corporate team of Goodman Derrick LLP, the London law firm.

The post Time to buy out your business partner? Here are four things to consider appeared first on UKTN (UK Tech News).