UK-based ilumoni is the UK’s first AI-powered borrower wellbeing app that uses uses open banking, credit and market data to build a fast, accurate and realistic picture of the user’s debt. Now, the company announced that it has received £1.63 million funding and gained FCA authorisation earlier this year. While it has successfully completed its beta testing, ilumoni has officially launched and is now available to download on Android and iOS devices.

Previous investments

Previously, the UK startup raised £340K pre-seed investment from Move Ventures, and angel investors including Simon Moran, former CMO, and now Non-Executive Director, Premium Credit, and Andy Deller, former CEO of Dunbar Bank plc, part of Zurich Insurance Group.

In a successful second bout of investment, the app raised a further £1.2 million in an oversubscribed seeding round, attracting over 25 additional angel investors to the project.

The investment has supported product development, marketing, trials and further expansion of the company, thereby leading to a 40 percent increase in the size of the workforce. This activity has supported ilumoni in launching on the open market.

Gary Wigglesworth, CEO, said, “ilumoni provides the impartial financial support that borrowers crave. Our research reveals over half of UK borrowers feel nervous talking to financial service providers about their borrowing, and 58% of people prefer using an app to chat about such topics. Top of our priority list is giving people the tools and insight they need to make confident, better-informed decisions when it comes to their borrowing.”

Improves borrowing options

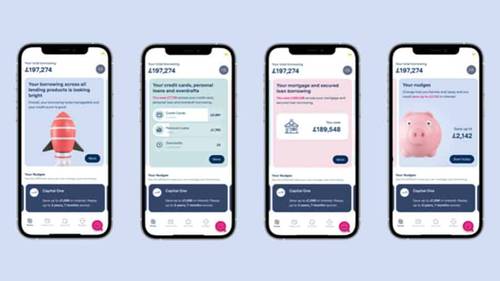

ilumoni was founded by Gary Wigglesworth and Jonathan Corner in 2019. The free to use, AI-driven app helps its users to understand and manage their borrowing in four simple steps. It asks users to set their priorities and brings together financial information from credit reports, credit cards, personal loans, mortgages, and bank accounts to give users visibility of what they owe, along with additional information on things such as interest costs and payment timeframes.

ilumoni lets users identify how they can improve their borrowing. The app shows them the benefits of making changes to repayments as well as alternative borrowing options, all based on what the user can afford and the products they are eligible for. The app encourages users to stay on track to reach their goals, which in the long term not only improves their financial situation but could also alleviate stress and anxiety.

The post UK’s first AI-powered borrower wellbeing app launches after raising £1.6M funding appeared first on UKTN (UK Tech News).