Open bank API translates to open banking Application Programming Interface (API). APIs allow banks to open their interfaces to third parties which leads to ease of use and faster service.

How do the open bank APIs work?

The existence of open bank APIs enables non-banks to connect to banking services. Third-party service providers (TPPs) are the non-bank businesses that use the bank’s data for their products. To make it clearer visualise any financial management app that acts as a prominent third-party service provider. These apps effectively benefit and reap revenues from using open banking.

TPPs gather information from all other sources where you might have your finances – like bank accounts. Then it showcases it in one place which is the financial management app. Consequently, you can obtain all of your financial information in one place and execute decisions accordingly. When you understand your financial situation you can easily oversee future expenditures, create achievable savings goals or even adjust spending behaviour.

Generally for the app to be able to aggregate this information to one place it needs to have API integration to bank systems.

However, to ease the process for TPPs within the integration it is possible to use an API banking platform. The purpose of those platforms is to assist with the integration and make the transition easier. Therefore, they provide an API layer that is placed on top of the bank’s system that allows the data sharing between a business and a bank.

Can open bank APIs be used in other ways?

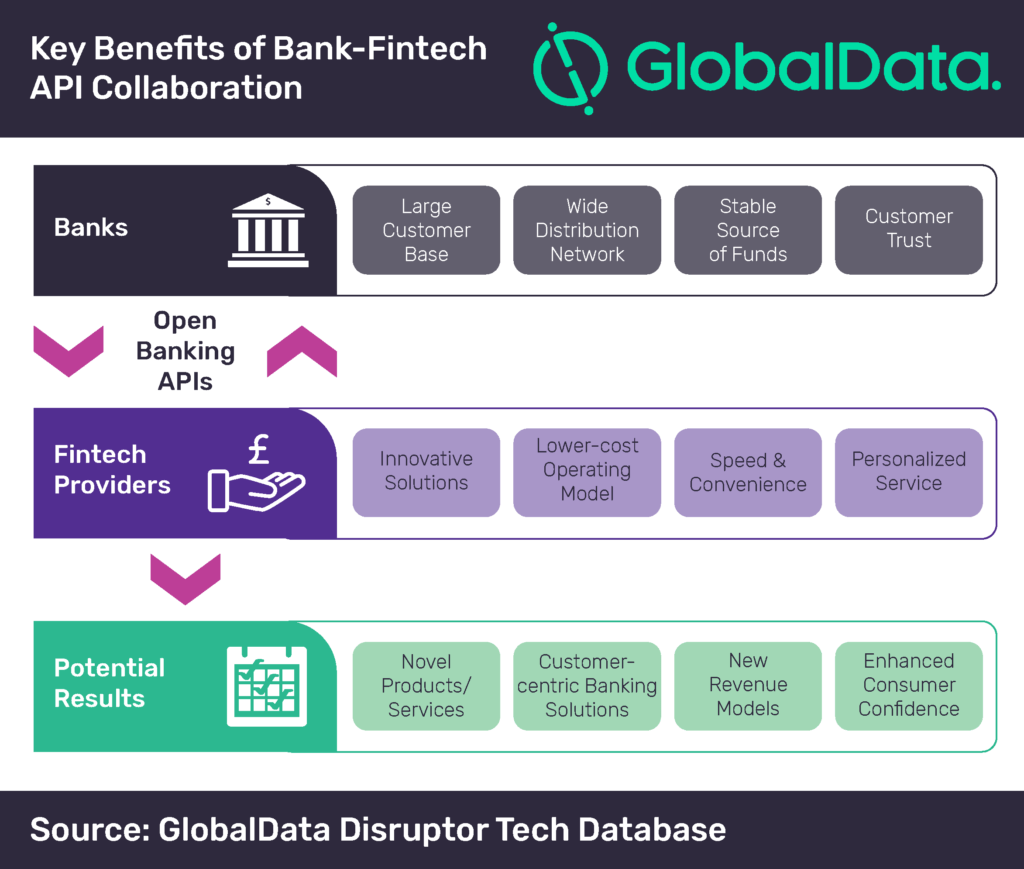

Nowadays, open banking APIs can be used in various other forms and not only for financial data gathering. Financial models like Banking as a Service (BaaS) and Software as a Service (SaaS) were also introduced to the financial indusatry which enabled open banking APIs to become widely spread and open new revenue opportunities not only to financial businesses.

Since the second EU payment service directive in 2019, the open bank API (https://nordigen.com/)became proliferating and easily accessible to third parties due to mandatory data opening from banks.

Who are third party service providers?

A third party service provider can become any non-bank business that necessitates collecting customer data in one place or trigger payments within their app or website. It is important to note that third service providers cannot aggregate your financial information without getting user permission. The consent might be in the form of a box-ticking or agreeing to terms of services.

The post The purpose of open bank APIs appeared first on .