Precision health technology company Perspectum has closed $36m (£30.4m) in its first round of Series C funding, led by Oppenheimer Holdings.

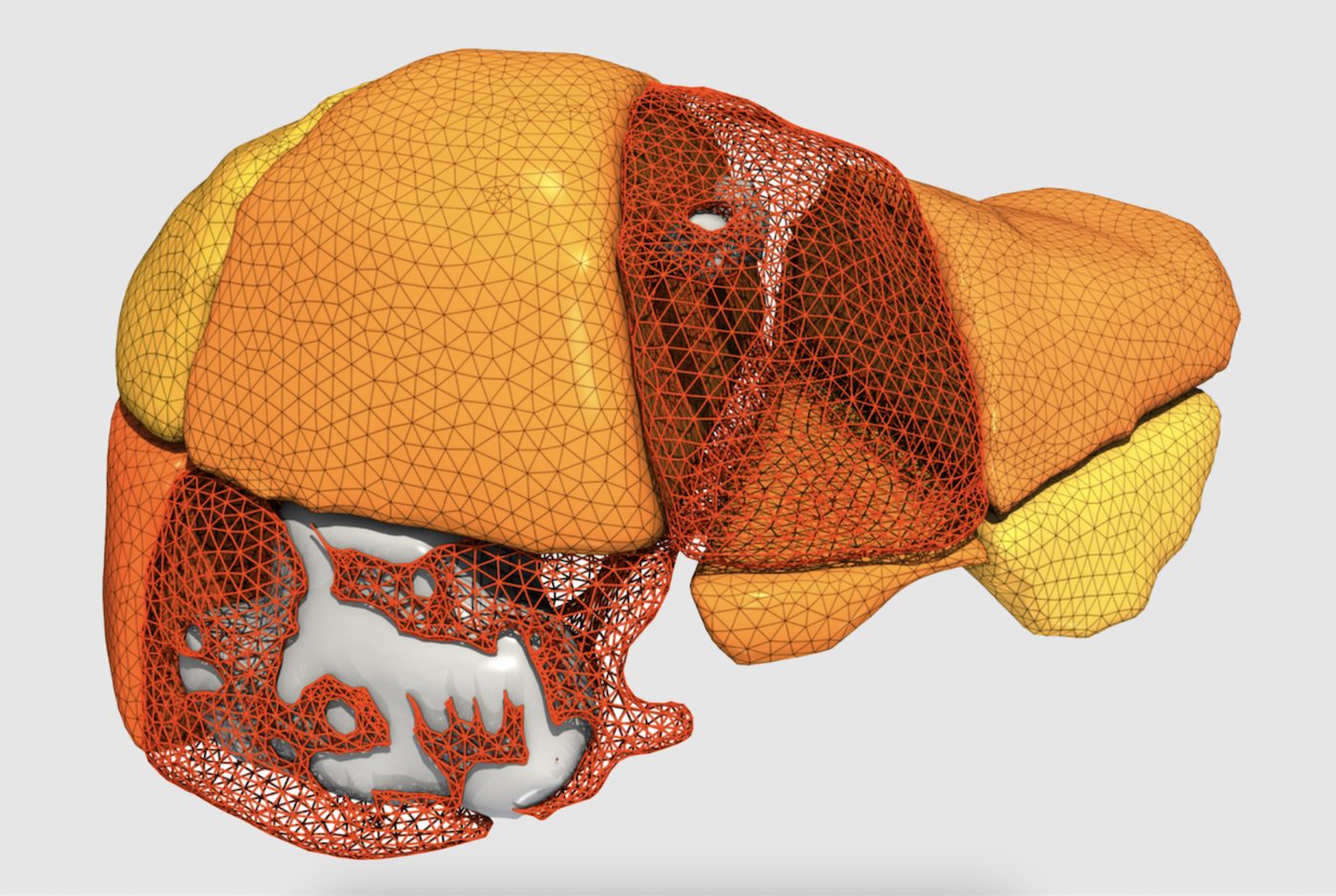

Oxford headquartered Perspectum provides body imagery software that connects to MRI machines and uses artificial intelligence (AI) to aid with diagnosis and monitor patients with chronic diseases.

to measure organ inflammation with greater precision, aiding diagnosis and the monitoring of patients with chronic diseases.

The company says its software provides “greater precision” when medical professionals measure organ inflammation in patients with metabolic diseases or cancer.

Rajarshi Banerjee, CEO of Perspectum, said: “This new funding will help us to continue innovating new products that will make healthcare safer by providing non-invasive alternatives to biopsy, totally changing how and when we can see and treat many diseases.”

The startup will also use the funding to scale its US operations, as well as its future multiorgan inflammatory conditions and oncology products.

The startup to date has raised approximately $120m (£101.2m). It has offices in Singapore, Texas, Portugal and San Francisco.

Oppenheimer Holdings led the Series C round, with participation from HealthQuest Capital, the Blue Venture Fund and British Patient Capital, which contributed £8.7m.

“Perspectum is a truly disruptive company with medical imaging software that can dramatically improve the standard of care for millions of patients, as well as provide a higher level of decision support for physicians,” said Robert Lowenthal, president of Oppenheimer Holdings.

The post Medical imaging company Perspectum raises £30m appeared first on UKTN | UK Tech News.