Over the past decade, the British fintech ecosystem has flourished. From a global perspective, the UK punches well above its weight, making up 10% of the worldwide fintech market, according to the recent Kalifa Review.

A symbiotic relationship between investors and entrepreneurs has been crucial to this success. Venture capital and growth equity firms look at the UK as a place in which to find and invest in cutting-edge fintech businesses with huge growth potential, abetted by their proximity to the City of London and British consumers’ willingness to adopt new financial technologies.

Fintech founders see the UK as the perfect place to launch a new business, with readily available access to funding and guidance from sophisticated investors who have supported multiple other success stories.

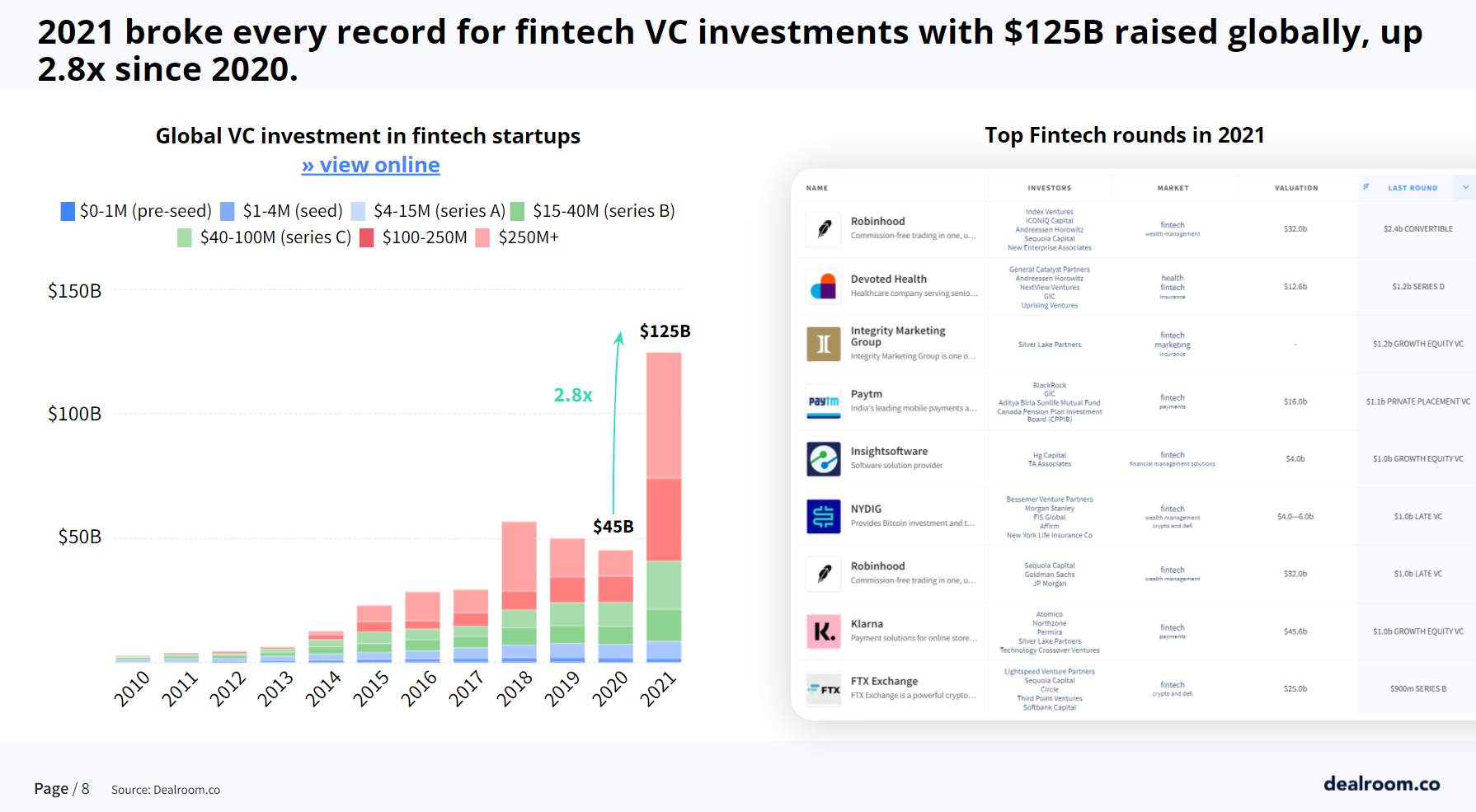

This ‘virtuous circle’ dynamic – promising businesses attract funding, which in turn attracts promising businesses, and so on – has driven investment into UK fintech companies to record highs. The UK accounted for nearly half the European total in fintech investment last year. In the first six months of this year, it ranked only second to the US as the biggest hub for fintech investment, according to Innovate Finance.

But the mood music within private funding markets has changed over the course of 2022. Fintech investors are asking a very different set of questions than before. We experienced this change in focus ourselves when raising our $110m Series C last November, and then, with the world financial markets pulling valuations down by over 80% in many cases, we successfully completed an oversubscribed $50m top-up to that round this summer. This totalled $160m in equity without the need to lower our previous $2bn valuation.

Market volatility

Historically, venture capital funding has been drawn towards – and then used to subsidise – fintech companies that could demonstrate rapid growth. An aggressive expansion in your customer base was the principal concern, for both founders and investors.

In the digital banking space, Revolut last year secured the highest valuation of any UK tech company – quintupling to $33bn – after passing 16 million users globally, despite annual losses rising year on year.

We experienced a similar dynamic. Our customer acquisition rates, which had taken us past one million customers a couple of months earlier, were central to our discussions with investors around our Series C round.

Then came the market volatility of early 2022, and everything changed. Rising interest rates, rampant inflation and falling valuations in the public markets had an immediate knock-on effect on how investors looked at and valued private fintech companies seeking to raise new equity funding. There were two major areas in which fintech businesses – particularly those offering a consumer-facing product – were suddenly being scrutinised much more closely.

Fintech investors focus on new metrics

Firstly, what is the nature of your relationship with your customer base? It’s all well and good to have reached millions of customers, but these numbers can be deceiving. Do you own the relationship with those customers, or are you reliant on other companies to refer them back to your product? Are you offering them a unique proposition to which they are loyal, or are they constantly on the brink of jumping ship to a competitor who offers the same commodified service?

The more longstanding and traditional operators in the buy now pay later space find themselves on the horns of this particular dilemma. Because they effectively finance the purchases made by the customers of the retailers for whom they process payments, they don’t own the relationship with those customers.

If their biggest retailer partners choose to put a different BNPL provider’s button on their checkout page, a chunk of their customer base disappears overnight. The biggest operators have suffered dramatic falls in valuations in recent months, in no small part for that reason.

The second area of increased investor scrutiny is whether a company’s product is monetisable and its margins sustainable. When we spoke to our investors over the summer, they placed much greater emphasis on the net transaction margin of the purchases made by our customers and our path to profitability.

Any fintech business seeking to raise more capital will need to have answers to these exact questions. It will, of course, do them no harm at all to be recording strong growth at the same time. But that will no longer be enough. Customer loyalty and commercial viability are increasingly front of mind for private fintech investors.

Philip Belamant is the CEO and co-founder of Zilch.

The post The VC playbook for investing in fintech during a market downturn appeared first on UKTN | UK Tech News.