Birmingham-based UK Innovation & Science Seed Fund (UKI2S) has added an extra £37m to its patient capital fund to invest in seed-stage startups operating in areas including synthetic biology, fusion energy and defence.

The fund will make investments into both private sector companies and technology developed in public sector laboratories and in partner research and innovation campuses.

Its goal is to “deliver economic gains” from the UK’s pubicly funded research.

“The fund’s expansion will help drive innovation with our partners, across research campuses and from synthetic biology industry, in addition to accelerating the development of high growth potential businesses in defence and security, fusion and exploiting the UK’s knowledge assets,” said Andrew Muir, investment director, Future Planet Capital Group and fund principal for UKI2S.

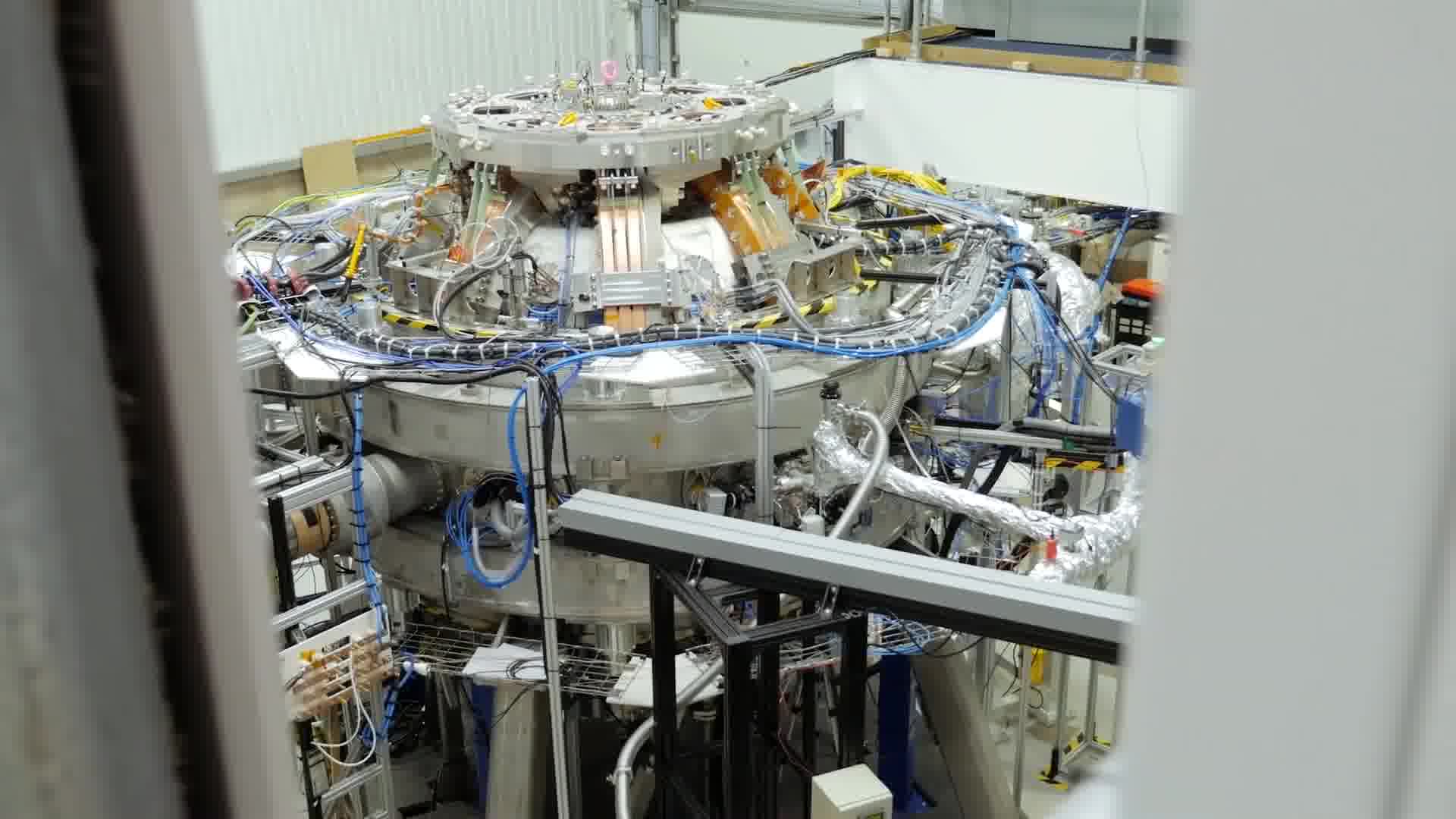

UKI2S is an early-stage investment fund that has backing from the likes of UK Research and Innovation (UKRI), Defence Science and Technology Laboratory (Dstl), the Department of Business, Energy and Industrial Strategy (BEIS), the UK Atomic Energy Authority (UKAEA) amongst others.

The early-stage investment fund is managed by Midven Ltd a division of Future Planet Capital Group.

Dr Liz Kirby, innovation director, Science and Technology Facilities Council, said: “I am delighted to announce the expansion of UKI2S as we boost investment in the UK’s most disruptive early-stage companies that are leading the way in finding solutions to the problems that we face across society.”

The fund can invest up to £1.5m in a startup but the average size of its equity stakes are £300,000.

Previous investments include Oxford Helix Geospace’s £3m seed funding last December, Coventry biotech NanoSyrinx’s £6m seed round and Welsh antibody drug discovery platform Antiverse.

London-headquartered Future Planet Capital manages $400m (£332m) and has a portfolio comprising more than 180 companies.

Venture capital fund Systemiq Capital earlier this month closed £59m to invest in early-stage climate tech startups.

The post UKI2S gets £37m boost to back British seed-stage startups appeared first on UKTN | UK Tech News.