Many of us will have already heard about companies like Wise (formerly TransferWise) and Revolut. Such companies are often seen as another version of PayPal by people who aren’t totally up-to-date on the remittance market.

The truth is that there’s a money transfer revolution going on. It would be classed as a natural, progressive evolution in how we’re becoming more efficient in sending money overseas, but that would neglect to highlight how traditional banks are being left behind and totally replaced.

Fintech international money transfer services are chomping at the bit, with outdated wire transfer practices that are literally belonging to the Victorian era period, which are still hegemonic among much of the public. It’s been shockingly easy for fintech firms like Wise to compete, with banks still facilitating cross-border transfers that cost the sender (or sometimes the recipient) around 6.9% for a $200 amount.

Of course, this isn’t the only absurdity, but the transfer may also take several days – or not appear at all if you write the recipient’s name wrong – or one of the many, many other details you have to write down. If we look at Revolut as a comparison: the user opens the app, and the app’s permission to access the phonebook, we can see who else uses Revolut based on their mobile number. You simply click on the name, type the amount, and send whilst using a GIF as a reference.

Not only does the money usually transfer instantly, but it’s often free too with a rate close to the interbank rate. Unless you’re sending large amounts or using exotic currencies, you can pretty much forget the worry of fees or non competitive rates.

This is why it’s a revolution. Banks, who are ‘too big to fail’, are also too big to adapt. With outdated legacy systems and a focus on revenue elsewhere, they’ve not been competitive within the remittance space for a long time. Whilst some people still use them for remittance, it can only be thought to be out of ignorance or a belief that they’re more secure.

Nexus Fast Payment System – The Inevitable Next Step?

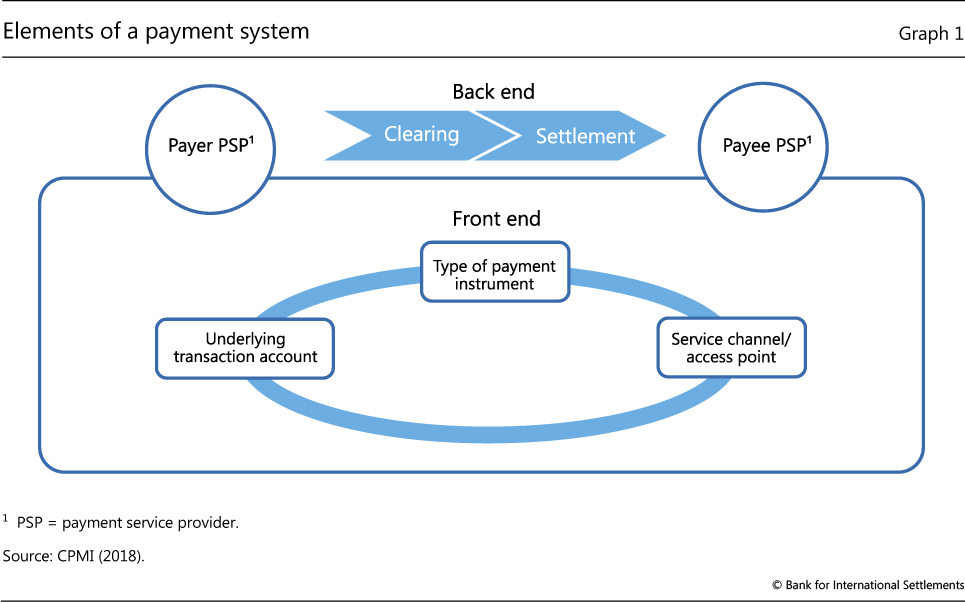

The Bank For International Payments (BIS) states that only 60 countries around the world have access to Fast Payment Systems (FPS). The FPS is a way in which bank customers can send money within a few seconds, which is much faster than the BACS system. However, this is often just domestically, and the individual systems of each country aren’t very well interconnected.

This is what Nexus aims to target: fast, cheap international transfers that only require a phone number, e-mail, or a QR code. With the confirmation of the person’s name popping up once this single piece of information is inputted, the user can safely transfer funds in an instant without the hassle of gathering addresses and bank numbers.

Nexus isn’t yet another fintech remittance company like Wise or Revolut. Nexus is an ambitious project by the BIS; a model to connect multiple national payment systems together into a cross-border platform. The idea is to make sending money a bit like sending a WhatsApp message – and why not? It does initially seem strange that this isn’t yet the norm.

Of course, people will again think of PayPal, but PayPal is an entirely different thing. Not only is it a private firm using a single system, in which you must have PayPal and so does the recipient, but that fees are almost as uncompetitive as a high street bank’s!

Nexus is looking at connecting the fast payment systems of each country. Of course, a Brit can send their landlord funds using their internet banking app and the money will be sent in seconds – so why can’t we do this when sending money abroad?

There are a lot of challenges that Nexus faces. Foreign exchange is one problem, but this is a hypercompetitive space right now, where even the smallest of fintech’s are accessing the interbank rate. Instead, the two other challenges are perhaps harder to tackle: regulatory compliance checks and reconciling different languages between payment systems.

But, the ramifications of streamlining a bridging platform for cheaper and faster international payments could be unprecedented. This is particularly pertinent in the current times of the pandemic, in which many businesses are turning to the global market, be it hiring employees or selling products.

We have already seen Singapore and Thailand link their domestic fast payment systems into a frictionless relationship. This has resulted in transfers that have the same qualities as domestic transfers: it takes seconds.

Whilst this is a good sign, the number of individual connections that it will require for 60+ countries to have relationships like this is a lot. For example, 20 countries to all are individually connected would require 190 links – suddenly this begins to sound logistically inefficient and difficult to manage.

This is exactly what Nexus is trying to solve: connect multiple FPSs in multiple countries, as well as coordinate the foreign exchange. BIS is making strides by speaking to more Central Banks to help develop this technology, which will hopefully one day bring high street banks up to speed with their fintech counterparts.

Race To The Bottom?

What we are beginning to see is the economic phenomenon of a race to the bottom. A race to the bottom, in which different vendors compete on price alone, results in profit margins hitting close to zero because there’s no room left to undercut. This happens in monopolistic markets (not markets with a monopoly), where products are homogenous – otherwise, they would compete on quality or service.

Well, FX wasn’t solely a monopolistic market. We know this because it’s a dream to use Revolut or Wise’s mobile app, whilst some other FX apps are horrendous. However, if Nexus achieves its goal and pretty much every remittance company can send money with the same level of efficiency, the product will be extremely similar.

Bespoke FX firms will always exist though, and they can charge more. Having a dedicated dealer and hedging expertise is worth paying a fee/margin for. But firms that are solely about sending money and nothing more will likely have a race to the bottom.

This is great for customers, of course, and it may mean spurring on more differentiation. For example, we can already see Revolut have stock and crypto-buying features on their app, and we will likely see even more functionality added if banks begin offering competitive remittance.

In some sense, we’re almost there even without Nexus and a more universal payment bridging system. The interbank rate can be obtained, and with zero fees, if the customer looks carefully enough. This already exists on Revolut, for example, though only with a small maximum transfer amount and with common currency pairs – and if it’s completed whilst markets are open. It’s impressive, but there are a significant amount of caveats.

Fintech’s with no such caveats tend to offer margins of around 0.5% to 1%, which many customers are happy with given the bank alternative. It will be interesting to see if fintechs, whilst currently making banks appear totally uncompetitive, may be the one who cannot compete themselves in the event of a Nexus system. After all, banks do not rely on FX margins and remittance costs as their main source of revenue.

With an endless array of lucrative financial products, if banks are given access to a drastically more efficient system, they may decide to end the revolution and make fintech transfer companies utterly obsolete.

The post The evolution of Fintech Payment Systems – is Nexus Fast Payments the inevitable next step? appeared first on .