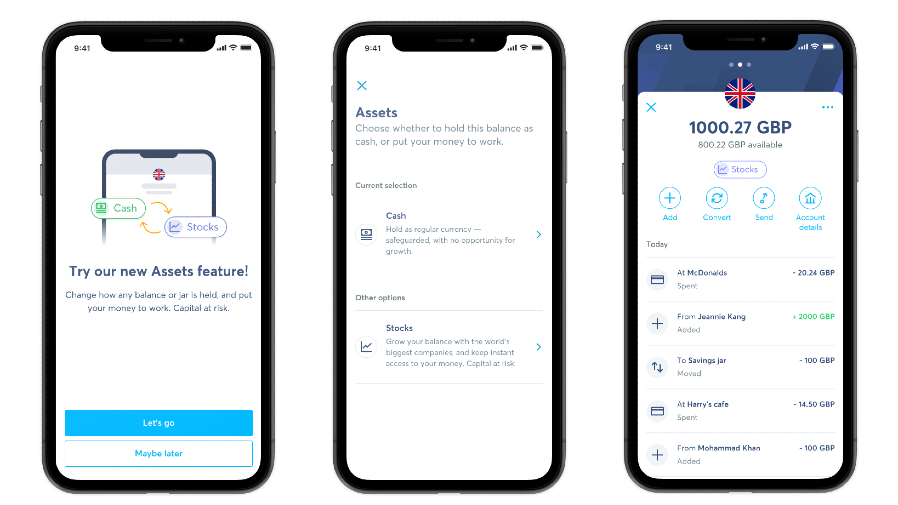

London-based global technology company, Wise has just introduced its multi-currency investment feature ‘Assets’ to UK customers. With Assets, individuals and businesses in the UK will get the opportunity to choose how their money is held, and potentially earn a return on their money, across 54 currencies.

Wise launches Assets feature

The first asset will be Stocks, a broad portfolio of 1,557 of the world’s largest public companies included in the MSCI World Equity index, including Apple, Amazon, and Google, and is collectively worth more than £40 trillion. Wise has selected BlackRock to provide the tracking fund for this index.

With the Asset feature, customers will have instant access to the majority of their money unlike in traditional banking. Users can hold their balance in Assets, and spend and send the money in real-time as and when they need it. By letting users access their money any time and letting them invest through multiple currencies, Wise eyes making it more convenient for its users to send, hold and receive money across currencies.

Globally, Wise Account balances have around £4.3 billion. Eventually, the company will focus on rolling out the Assets feature across Europe as the next big step. Wise Account holders in the UK will be able to access Assets from today. Wise Business customers can start using Assets on the web; it, it can be accessed via the Wise mobile app in a few weeks.

Protected investments!

Investments held in Assets could be entitled to compensation from the Financial Services Compensation Scheme (FSCS) for up to £85,000. The value of investments and the income from them can rise or fall and there is no guarantee about it. Usually, capital is at risk and investors may not get back the amount originally invested.

Kristo Käärmann, CEO and co-founder of Wise said: “People all over the world are holding billions in their Wise and Wise Business accounts for the long-term. But holding money in various currencies can be hard to manage efficiently. Assets is seeking to solve that problem, by providing an opportunity for customers to earn a return on their money with us, in a host of different currencies, all in one place.”

Joe Parkin, Head of Banks and Digital Channels in the UK at BlackRock added: “People are increasingly turning to a single app to manage their financial lives and improve their wellbeing. Offerings, such as Assets from Wise, are bringing financial services into the digital age and in-line with consumers’ expectations. Providing people with investments alongside other financial products is critical to helping them achieve their long-term goals.”

How does ‘Assets’ work?

UK customers can tap ‘Cash’ on any of their balances or jars, then select ‘Stocks’, which will invest the money held into the chosen index fund. The BlackRock iShares World Equity Index Fund invests in hundreds of the world’s biggest companies. The earnings are represented in the customer’s balance currency and are updated daily. Almost 97 percent of customer money is available to use instantly and customers can switch the money they hold in stocks back to cash at any time.

Notably, the overall cost of the product will include a 0.55% service fee to Wise and a 0.15% fund fee to BlackRock.

The post Wise launches ‘Assets’ to lets UK customers use their money invested in stocks appeared first on UKTN (UK Tech News).