Getsafe wants to make deep in-roads into the insurance market by targeting millennials in its long-term growth strategy. A year after entering the UK insurance market, the German insuretech startup feels ready to repeat the success it has already seen in home country.

Started by Christian Wiens and Marius Simon in 2015, Getsafe had been active in two European markets before entering the UK, which it saw as a key target because of the wide adoption of fintech, most notably challenger banks. The brand has over 170 thousand customers in Europe. The company offers an app-based approach, digitising policies and claims using AI to reduce administrative costs.

The inspiration

Wiens was inspired to start Getsafe after his first, unsuccessful, experience with insurance cover: “I damaged something in my rented apartment and thought I was still covered by my parents. My parents showed me the shelf with their insurance; they’d accumulated hundreds of pages of complex insurance details over the years.”

The experience, followed by trying to navigate the options when deciding what type of insurance he needed, started Wiens thinking about how the industry could be made more attractive.

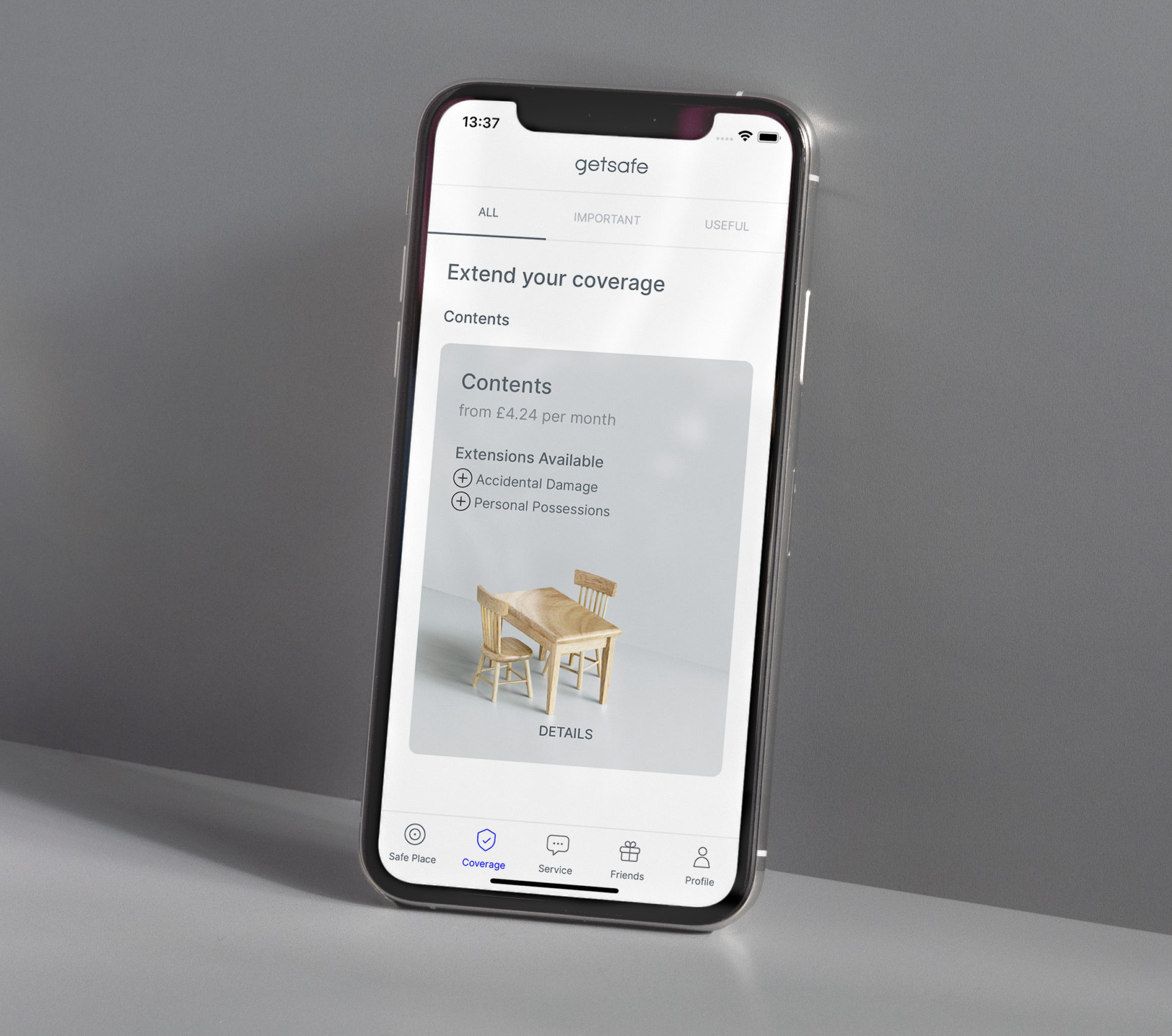

“Insurance is linked to adulthood, to becoming financially independent. But people avoid it because of the complexity and bureaucracy,” Wiens said. “We try to take this complexity away, so use a mobile app as sleek as the apps they have for their banking. It’s simple, paperless and affordable.”

Getsafe’s key selling point is the app that handles the whole process, avoiding the costs traditional insurers incur with staffing, agents and brokers.

UK growth

Since launching in the UK Getsafe now features on three of the leading price comparison sites — Quotezone, Confused.com and GoCompare — a key to gaining exposure and brand recognition. They have also expanded their product range, offering UK clients cover for accidental damage, personal possessions, home emergency, tenant liability and legal protection.

Flexibility is also a core feature of Getsafe, as well as offering the ability to precisely select cover there is no long-term contract. Clients can end their policies from within the app with very little notice.

Across Europe Getsafe now have over 170 thousand members with 200 thousand active policies. But the growth has been rapid, since securing $30 million (£22.4 million approx.) funding from Swiss Re in 2020 the company has grown by 350%. Germany, the company’s home, has been the strongest market where it is now the most sold insurance band for millennials.

Opportunity in challenge

The company’s move into the UK market may have been seen by some as bad timing, launching as the country was formally leaving the European Union and as the enormity of the coronavirus pandemic was starting to spread from Asia and into Europe.

Although Brexit has created uncertainty, Getsafe launched in that period fully aware of the risks. Setting up a UK subsidiary to meet UK regulations, so they were not dependent on the outcome of the withdrawal negotiations. But the pandemic actually proved a positive.

“In times of crisis, people think more about insurance; they want to protect what’s important to them.” Wiens said, but beyond the psychology of insurance, the Getsafe business model gave them an additional edge. “Agents and brokers are still the predominant way of distributing insurance, and they can’t sell in the same way. That gave us an extra boost, so we got stronger during the pandemic.”

Future expansion

Wiens is ambitious for Getsafe’s future, which he sees as being driven by long-term growth, winning first-time buyers and retaining them as their needs change. “We want to be the insurer for choice for people buying insurance for the first time.” Wiens explains, “as they go through life they will need more coverage. We plan to be a big insurance company in 10 to 20 years. Right now, we are laying the foundations for that.”

Globally the insurance industry is worth more than €4 trillion annually, and Getsafe estimate that around one million people buy their first insurance policy in Europe each year, creating a market worth €300 billion over the next decade. Getsafe aim to replicate their success in Germany by capturing ten per cent of that market.

Over the next year, Getsafe is planning to launch in all the major European markets they do not operate, including Spain, Austria, Switzerland and the Netherlands. They are also seeking pan-European licensing to allow them to operate throughout Europe. But the UK is a key market for them.

“Getting to a substantial market share in the UK of, for example, 10% of first-time insurance buyers is one of our major goals.” Wiens feels that the UK, which has less competition than their German arm, is ripe for rapid expansion.

However, they recognise the need for local knowledge, so while a large part of the 230-strong team is based in Germany — just seven are currently employed in London — Wiens plans to use the opportunity of remote employment to grow the team across Europe and globally, bringing not just local knowledge but the best talent.

The post Getsafe: Can the German insurtech repeat its success in the UK market? appeared first on UKTN (UK Tech News).