Family Recovery Plan has today launched its innovative personal storage platform; myFRP, which serves as an online vault where users can keep important information to do with money, family, logins and passwords, and personal details in one hack-tested place. The launch comes as myFRP’s own research reveals one in four (24%) Brits feel they wouldn’t know enough about their partners finances to confidently wind up their estate in the event of a sudden death.

The myFRP online service was launched in 2019 and can be accessed for every-day admin use or to keep all personal data in one place for loved ones to unlock in the event of a death or other sudden accident – making end-of-life planning simpler, safer, and more efficient.

The idea for the SaaS-based platform was born in 2011 out of company Innovator Bernerdine Noronha’s personal experience with the very issues myFRP will now solve, when her husband unexpectedly became unwell. When thinking practically about how to manage and cope with the news, Bernerdine knew she needed a means to organise her family affairs, but found that the information and data she needed was disparate and hard to locate. Realising how many families must face this same problem, she came up with the idea for myFRP as a practical solution.

Bernerdine Noronha, Innovator of myFRP, commented: “I designed myFRP because I had need of this service at a very challenging time for my family, and I wanted to ensure that such a facility is there to provide these useful services for people at what is already a very difficult time.

“Understandably, we do not like thinking about our own deaths, but myFRP is a great way to ensure you have everything in one place so that your loved ones can better manage should you pass away or be otherwise in need of their assistance. Our platform is there for users to bring the messy world of personal data into one simple, manageable and secure place.”

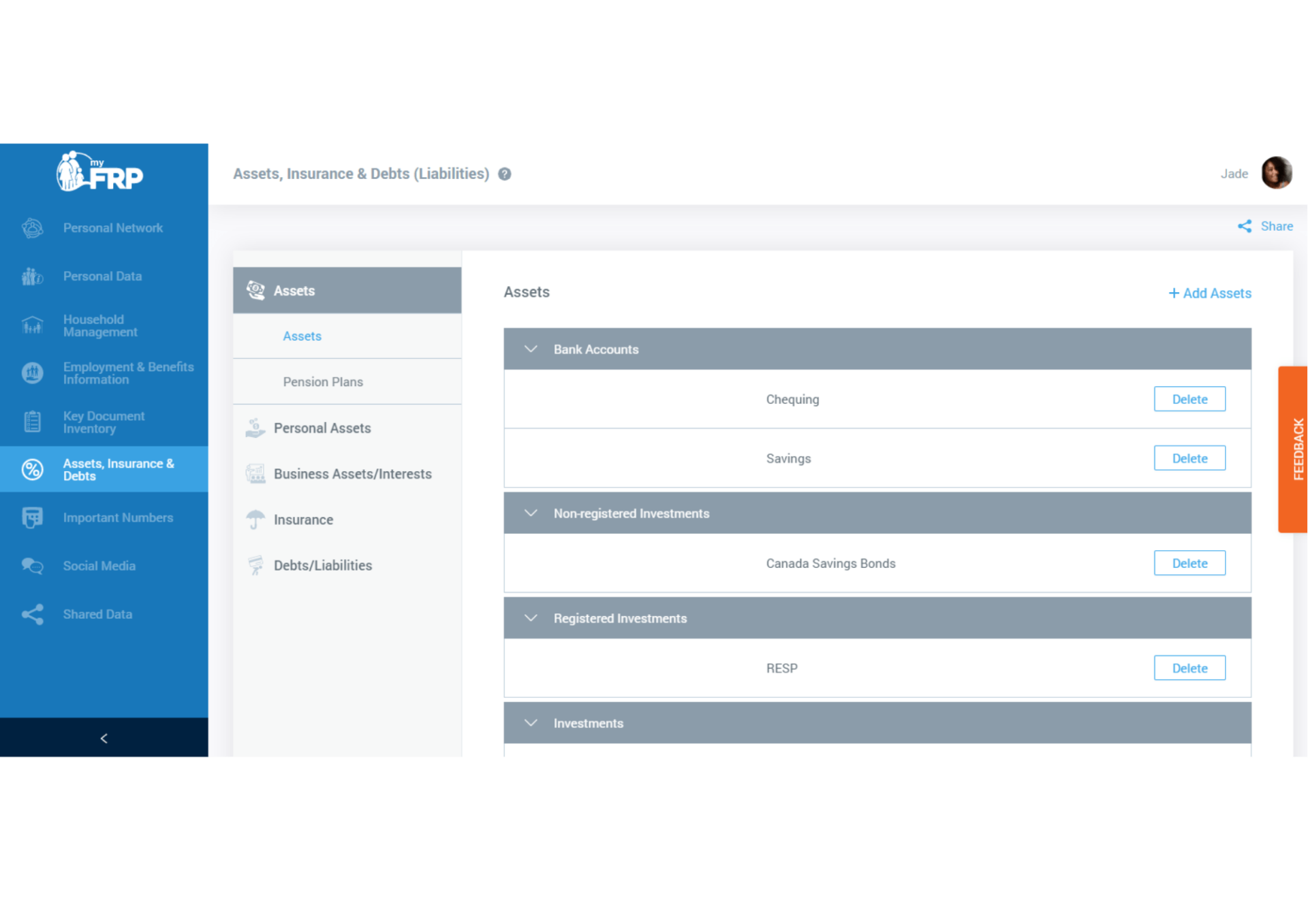

The platform is now available to the UK public following a successful pilot. Sensitive data can be stored easily – from pension plans to shared bank accounts, investments, life insurance and wills. All information is protected by more than 90 top-level certifications and compliances, including CREST certified hack testing, ISO 27001 Certification, PCI DSS Certification and GDPR compliance, so that personal data is secure. Users can nominate up to five people who can access specific information free-of-charge when required.

Brits falling behind on end-of-life planning

Alongside the launch, a myFRP survey of 2,000 UK consumers found a third of Brits (33%) wouldn’t be able to access everything they needed about a loved one’s personal affairs if they passed away suddenly. A further 22% were unsure if they would be able to access this information.

Those aged 45 to 54-years-old (37%) were most likely among age groups to say they wouldn’t be able to access what they needed if a loved on passed away suddenly, with a further 23% saying they were unsure.

The research also revealed a quarter of Brits (25%) do not have all the details of their children’s affairs and plans if their partner or co-parent were to pass away. myFRP can help ensure such critical life admin can be carried out without added stress in any difficult circumstances where a partner is incapacitated.

The post Online SaaS platform launched to help consumers keep track of digital footprint appeared first on .